nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

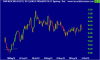

A-REIT Sector: Weekending Friday 16 August 2019

The Dow Jones had a 700+ point correction so we had to drop 170+ points. Personally I can't understand the basis of our market being so low. The US not only recovered to their high of 2007 but went on to double. Our market took ten years to recover and is no where near as over inflated as the Dow Jones. Additionally in 2007 our market was inflated (overpriced) with many of the companies having excessively high debt to equity ratios. Realistically many of the companies were paying high dividend rates using borrowings to fund the dividends. Not now. Dividend rates are slightly lower and are mostly paid from earnings. Even the retail A-REITs are paying 5% plus yields, all from earnings, yet they are being held down, trading at less than their net tangible asset values. At some point these shares are going to look good, particularly to long term overseas investors taking advantage of our sliding dollar. One again there is two weeks of data included. I will have to give myself "a couple of backhands" to smarten up my act. Good luck .

.

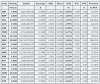

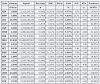

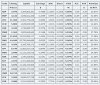

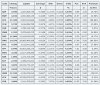

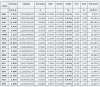

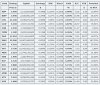

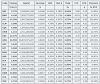

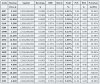

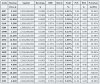

The A-REIT Table for closing prices for Weekending Friday 09 August 2019 follows:

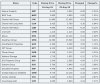

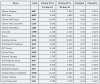

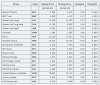

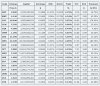

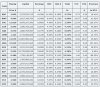

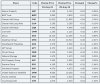

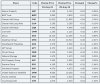

The comparison table of weekending 09 August 2019 closing prices versus the previous weeks closing prices follows:

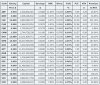

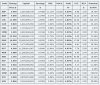

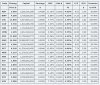

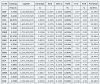

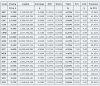

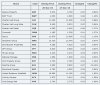

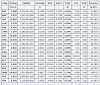

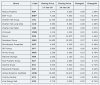

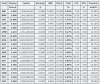

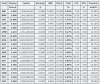

The A-REIT Table for closing prices for Weekending Friday 16 August 2019 follows:

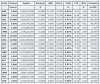

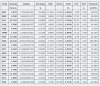

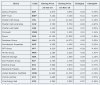

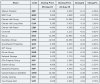

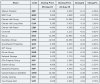

The comparison table of this weekending 16 August 2019 closing prices versus the previous weeks closing prices follows:

Comments:

1. The shares listed in the tables above make up the ASX 200 XPJ A-REIT Property Sector.

2. The "Capital" figures in the above tables are "market capital" based on the "issued shares" as distinct from "free float capital". The "issued shares", updated as at 05 April 2019, can change from day to day due to active share buy-back programs and other factors.

3. The "Capital", "Earnings", "Distribution" and "NTA" figures have also been updated as at 05 April 2019. "NTA" figures are subject to change every time there is a property re-valuation and the table may be out by a few cents from time to time, which effects the "Premium to NTA" also.

4. Inclusion of any share details in the above tables is not an endorsement of that share as a viable investment or possible trade.

Disclaimer: These tables may contain errors and should not be relied upon for investment decisions. As always, do your own research and good luck .

.

The Dow Jones had a 700+ point correction so we had to drop 170+ points. Personally I can't understand the basis of our market being so low. The US not only recovered to their high of 2007 but went on to double. Our market took ten years to recover and is no where near as over inflated as the Dow Jones. Additionally in 2007 our market was inflated (overpriced) with many of the companies having excessively high debt to equity ratios. Realistically many of the companies were paying high dividend rates using borrowings to fund the dividends. Not now. Dividend rates are slightly lower and are mostly paid from earnings. Even the retail A-REITs are paying 5% plus yields, all from earnings, yet they are being held down, trading at less than their net tangible asset values. At some point these shares are going to look good, particularly to long term overseas investors taking advantage of our sliding dollar. One again there is two weeks of data included. I will have to give myself "a couple of backhands" to smarten up my act. Good luck

The A-REIT Table for closing prices for Weekending Friday 09 August 2019 follows:

The comparison table of weekending 09 August 2019 closing prices versus the previous weeks closing prices follows:

The A-REIT Table for closing prices for Weekending Friday 16 August 2019 follows:

The comparison table of this weekending 16 August 2019 closing prices versus the previous weeks closing prices follows:

Comments:

1. The shares listed in the tables above make up the ASX 200 XPJ A-REIT Property Sector.

2. The "Capital" figures in the above tables are "market capital" based on the "issued shares" as distinct from "free float capital". The "issued shares", updated as at 05 April 2019, can change from day to day due to active share buy-back programs and other factors.

3. The "Capital", "Earnings", "Distribution" and "NTA" figures have also been updated as at 05 April 2019. "NTA" figures are subject to change every time there is a property re-valuation and the table may be out by a few cents from time to time, which effects the "Premium to NTA" also.

4. Inclusion of any share details in the above tables is not an endorsement of that share as a viable investment or possible trade.

Disclaimer: These tables may contain errors and should not be relied upon for investment decisions. As always, do your own research and good luck