nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

A-REIT Sector: Weekending Friday 09 November 2018

The week before last, the A-REIT Sector spent the first two days trying to recover from the previous week but the last three days proved that the recovery was little more than a dead cat bounce. However this week our markets rebounded, including the A-REIT Sector. What changed, well it seems that global markets like Donald Trump as President of the U.S.A. I find this really scary that someone who appeals to extreme right wing activists has a good chance of emulating Ronald Regan and serving two (2) terms as President of the U.S.A. Good luck. .

.

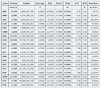

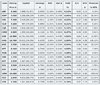

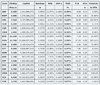

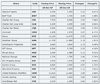

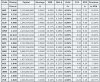

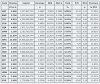

The A-REIT Table for closing prices for Weekending Friday 09 November 2018 follows:

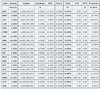

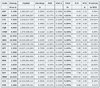

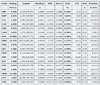

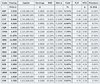

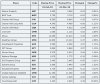

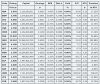

The comparison table of this weeks closing prices versus last weeks closing prices follows:

Comments:

1. The shares listed in the tables above make up the ASX 200 XPJ A-REIT Property Sector.

2. The "Capital" figures in the above tables are "market capital" based on the "issued shares" as distinct from "free float capital". The "issued shares", updated as at 22 June 2018, can change from day to day due to active share buy-back programs and other factors.

3. The "Capital", "Earnings", "Distribution" and "NTA" figures have also been updated as at 22 June 2018. "NTA" figures are subject to change every time there is a property re-valuation and the table may be out by a few cents from time to time, which effects the "Premium to NTA" also.

4. Inclusion of any share details in the above tables is not an endorsement of that share as a viable investment or possible trade.

Disclaimer: These tables may contain errors and should not be relied upon for investment decisions. As always, do your own research and good luck .

.

The week before last, the A-REIT Sector spent the first two days trying to recover from the previous week but the last three days proved that the recovery was little more than a dead cat bounce. However this week our markets rebounded, including the A-REIT Sector. What changed, well it seems that global markets like Donald Trump as President of the U.S.A. I find this really scary that someone who appeals to extreme right wing activists has a good chance of emulating Ronald Regan and serving two (2) terms as President of the U.S.A. Good luck.

The A-REIT Table for closing prices for Weekending Friday 09 November 2018 follows:

The comparison table of this weeks closing prices versus last weeks closing prices follows:

Comments:

1. The shares listed in the tables above make up the ASX 200 XPJ A-REIT Property Sector.

2. The "Capital" figures in the above tables are "market capital" based on the "issued shares" as distinct from "free float capital". The "issued shares", updated as at 22 June 2018, can change from day to day due to active share buy-back programs and other factors.

3. The "Capital", "Earnings", "Distribution" and "NTA" figures have also been updated as at 22 June 2018. "NTA" figures are subject to change every time there is a property re-valuation and the table may be out by a few cents from time to time, which effects the "Premium to NTA" also.

4. Inclusion of any share details in the above tables is not an endorsement of that share as a viable investment or possible trade.

Disclaimer: These tables may contain errors and should not be relied upon for investment decisions. As always, do your own research and good luck