- Joined

- 18 February 2006

- Posts

- 4,200

- Reactions

- 2

Re: XAO Analysis

Hey Nick,

Thanks for the update, wow 13,900 sure would be nice for the DJIA!

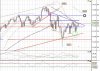

Its amazing how the XAO was on the 6,200 line yesterday, if Bernake's speech killed US markets XAO would have been ripe for a fall below it, luckily US rallied strongly last night and has thus given Aus mkts breathing space above the 6,200 line,

So it looks like Kennarico's Inverted Head and Shoulders pattern is still in play

My comments to subscribers last night was the DJIA had completed its corrective phase and was more than likely now on its way to 13,900 as a minimum. However, this in direct conflict with the most probable pattern in the XJO. The XJO has had a 3-wave decline (30-min chart) off the Sept 5 high but its not, in my view, of typical depth suggesting that more is to come.

Hey Nick,

Thanks for the update, wow 13,900 sure would be nice for the DJIA!

Its amazing how the XAO was on the 6,200 line yesterday, if Bernake's speech killed US markets XAO would have been ripe for a fall below it, luckily US rallied strongly last night and has thus given Aus mkts breathing space above the 6,200 line,

So it looks like Kennarico's Inverted Head and Shoulders pattern is still in play