Porper

Ralph Nelson Elliott

- Joined

- 11 August 2004

- Posts

- 1,413

- Reactions

- 274

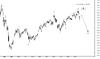

One more wave up to complete a generational Elliott structure?

It's difficult to label the higher degree count that this would create without more data, but the S&P also feels like it has one more substantial wave before a generational market top.

Youd think this Wave 4 down would find good support around 5600.

View attachment 90012

One of the 3 Elliott rules that can never be broken is that wave 4 can not break down through wave 1 which is the case in your red count. Also corrective patterns must not be straight line moves (your waves 2 & 4 in blue. I'll put a chart up on my take tomorrow. Bottom line is the patterns higher look corrective which is not a good sign. This has been the case off the 2009 lows.