- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

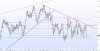

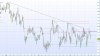

http://thepatternsite.com/diamondb.htmlforgive my ignorance, but what does a diamond imply or point to? I can see it in your image, but the interpretation is beyond me. (I don't have time at the moment to watch the video, and from the title, do not think the answer is there.)

The video will give you clues about how certain beliefs/attitudes will make you trade a pattern like a diamond correctly/incorrectly. Hope that makes sense.