- Joined

- 19 July 2016

- Posts

- 590

- Reactions

- 94

Hi SKC - do you have any stats on this?

I tried doing some numbers myself and wanted to see I was on the right track :1zhelp:

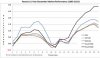

I couldn't see any notable difference in terms of performance between the first and second weeks of January. Looks like the first few weeks as a whole over the past 7 years aren't too promising (xjo stats).

Thanks

Interesting

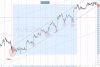

So is the 'new year' seasonality effect actually there or not?

It looks like early January is negative seasonally from that image.

Recently positive market moves in December.