theasxgorilla

Problem solved... next bubble.

- Joined

- 7 December 2006

- Posts

- 2,343

- Reactions

- 1

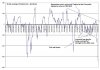

Re: XAO Analysis

I actually expected a bigger fall today that what we got. It's almost like the market goes limit down, as opposed to free fall. Perhaps markets are actually becoming more efficient these days?Is there a case for big crash?