Wysiwyg

Everyone wants money

- Joined

- 8 August 2006

- Posts

- 8,428

- Reactions

- 284

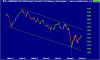

Just noticed the 250 DEMA has crossed down over the 250 EMA three times over the last 15 + years. On each occasion the Index dropped further and not more dramatically than in 2008. The third and most recent cross down was on the 18th of this month. Keeps me cautious though it might be different this time.