GreatPig

Pigs In Space

- Joined

- 9 July 2004

- Posts

- 2,368

- Reactions

- 14

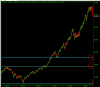

Re: XAO Analysis

I don't think too many successful trading systems are based on prayer...

GP

I don't think too many successful trading systems are based on prayer...

GP