Re: XAO Analysis

You guys are all thinking it'll go down to 3700?? Holy ****....

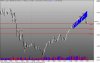

I guess it looks like one of those bearish ascending wedges I read about on the paper... but I have a hard time believing it'll go down much further than 4200, then again I'm a newbie you guys make money off from.

You guys are all thinking it'll go down to 3700?? Holy ****....

I guess it looks like one of those bearish ascending wedges I read about on the paper... but I have a hard time believing it'll go down much further than 4200, then again I'm a newbie you guys make money off from.