theasxgorilla

Problem solved... next bubble.

- Joined

- 7 December 2006

- Posts

- 2,343

- Reactions

- 1

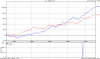

Re: XAO Analysis

I thought the same thing. Although what threw me was that my portfolio gained about 4% on Thursday and did nothing on today's technical breakout. I haven't delved into it yet to try and figure out which shares drove todays breakout. Nothing to do now except hurry up and wait for Monday

Shame for our markets, I thought the hold above 6450 was pretty bullish short term.

I thought the same thing. Although what threw me was that my portfolio gained about 4% on Thursday and did nothing on today's technical breakout. I haven't delved into it yet to try and figure out which shares drove todays breakout. Nothing to do now except hurry up and wait for Monday