You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

XAO Technical Analysis

- Thread starter Sean K

- Start date

- Joined

- 19 April 2007

- Posts

- 71

- Reactions

- 0

Re: XAO Analysis

As long as we don't break the last low at 6216, she'll be fine. But now I'm putting my trading range cap back on .

.

-----------------------------

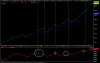

Here's an interesting chart comparing the relative strength of XAO with XSO (small ordinaries). Notice how sustainable market rallies occur when XSO is stronger and corrections ensue when new highs in the market are coupled with relative weakness of XSO v XAO.

As long as we don't break the last low at 6216, she'll be fine. But now I'm putting my trading range cap back on

-----------------------------

Here's an interesting chart comparing the relative strength of XAO with XSO (small ordinaries). Notice how sustainable market rallies occur when XSO is stronger and corrections ensue when new highs in the market are coupled with relative weakness of XSO v XAO.

Attachments

>Apocalypto<

20.03.2012

- Joined

- 2 February 2007

- Posts

- 2,233

- Reactions

- 2

Re: XAO Analysis

Evening all,

Well plan A has changed and I have now moved to plan B.

We failed with a positive drive to beat 6400 on a third time XJO. Wall St futures are down with a possible negative influence coming into todays trading. I was stopped on my add to the xjo and also closed my other xjo contract after seeing the days action. also closed my ASX share position to lighten my exposure

Now waiting to see if this short term trend line stands up to this new test. But there has still been some fun trades made off the bottom to the top in the last couple weeks.

This side ways market has just got more confirmation.

Good trading

Evening all,

Well plan A has changed and I have now moved to plan B.

We failed with a positive drive to beat 6400 on a third time XJO. Wall St futures are down with a possible negative influence coming into todays trading. I was stopped on my add to the xjo and also closed my other xjo contract after seeing the days action. also closed my ASX share position to lighten my exposure

Now waiting to see if this short term trend line stands up to this new test. But there has still been some fun trades made off the bottom to the top in the last couple weeks.

This side ways market has just got more confirmation.

Good trading

Attachments

- Joined

- 16 June 2007

- Posts

- 348

- Reactions

- 1

Re: XAO Analysis

The SPI Futures is down 63 points last time I checked, so that's a little worrying for those holding long in the index (or holding long in most of the bigger stocks, for that matter). I guess we'll really have to very carefully look at how low it drops this time to say where the index is heading in the near future.

The SPI Futures is down 63 points last time I checked, so that's a little worrying for those holding long in the index (or holding long in most of the bigger stocks, for that matter). I guess we'll really have to very carefully look at how low it drops this time to say where the index is heading in the near future.

professor_frink

Moderator

- Joined

- 16 February 2006

- Posts

- 3,252

- Reactions

- 5

Re: XAO Analysis

what are you saying here gfresh? I don't quite understand.

I am not sure how much indication we can truly gather from the SPI at the moment.. as just the other day it was +20-30 points. Now it's down, may be equally go up when today's down goes back up again?

what are you saying here gfresh? I don't quite understand.

professor_frink

Moderator

- Joined

- 16 February 2006

- Posts

- 3,252

- Reactions

- 5

Re: XAO Analysis

oh ok then. What the overnight session in the SPI will tell you is roughly where the day session will open. I say roughly, as there can sometimes be small gaps on the day session open. Once the cash market is open- the SPI and XJO move in tandem.

what I was getting at is that any movement down may be cancelled out quickly, as per recent movements.. but I am not an expert on the SPI

oh ok then. What the overnight session in the SPI will tell you is roughly where the day session will open. I say roughly, as there can sometimes be small gaps on the day session open. Once the cash market is open- the SPI and XJO move in tandem.

CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

Re: XAO Analysis

Pssssssst, Gfresh, wrong chart.

Cheers,

what I was getting at is that any movement down may be cancelled out quickly, as per recent movements.. but I am not an expert on the SPI

Pssssssst, Gfresh, wrong chart.

Cheers,

>Apocalypto<

20.03.2012

- Joined

- 2 February 2007

- Posts

- 2,233

- Reactions

- 2

Re: XAO Analysis

I would like to see that Nizar I closed my xjo longs on friday afternoon at our latest fail to break and close over 6400 now not making any new long plays until we close above it on xjo at a new hight to confirm the break out.

With oil up and the DOW up on friday, I think XAO is looking good for a close at or above 6,450 and a break into blue skies.

I would like to see that Nizar I closed my xjo longs on friday afternoon at our latest fail to break and close over 6400 now not making any new long plays until we close above it on xjo at a new hight to confirm the break out.

theasxgorilla

Problem solved... next bubble.

- Joined

- 7 December 2006

- Posts

- 2,343

- Reactions

- 1

Re: XAO Analysis

Check out http://tremblinghandtrader.typepad.com if you want an indication of what happened to our market on Friday, the SPI overnight and the US markets. I think he makes a good case that supports Nizars assessment that a breakout is on the cards Monday morning.

ASX.G

Check out http://tremblinghandtrader.typepad.com if you want an indication of what happened to our market on Friday, the SPI overnight and the US markets. I think he makes a good case that supports Nizars assessment that a breakout is on the cards Monday morning.

ASX.G

- Joined

- 23 October 2005

- Posts

- 859

- Reactions

- 0

Re: XAO Analysis

Not sure about the significance of this breakout just yet, but after analysing the pattern of the trend, there is descent probability this breakout will probably be a dud, at least in the near term. Have time cycles for some type of top(short or long term not sure just yet) for mid July. Have another date of August 22nd but not sure of the significance of this (ie a higher high or lower high just yet).

The way I am playing it, this breakout will stall early next week and prices will probably move back down to approximately 6200 before doing anything else. So I am seting up for a short term position, short position either Monday evening or Tuesday, and will assess again thereafter.

Cheers

Check out http://tremblinghandtrader.typepad.com if you want an indication of what happened to our market on Friday, the SPI overnight and the US markets. I think he makes a good case that supports Nizars assessment that a breakout is on the cards Monday morning.

ASX.G

Not sure about the significance of this breakout just yet, but after analysing the pattern of the trend, there is descent probability this breakout will probably be a dud, at least in the near term. Have time cycles for some type of top(short or long term not sure just yet) for mid July. Have another date of August 22nd but not sure of the significance of this (ie a higher high or lower high just yet).

The way I am playing it, this breakout will stall early next week and prices will probably move back down to approximately 6200 before doing anything else. So I am seting up for a short term position, short position either Monday evening or Tuesday, and will assess again thereafter.

Cheers

CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

- Joined

- 19 April 2007

- Posts

- 71

- Reactions

- 0

Re: XAO Analysis

I'd have to agree with that.

In regards to the new high in the US, have a read of this.

We'll probably be stuck in this trading range for a while unless the likes of NAB, ANZ and WBC get off the a$$e$ and start rising.

Not sure about the significance of this breakout just yet, but after analysing the pattern of the trend, there is descent probability this breakout will probably be a dud, at least in the near term.

I'd have to agree with that.

In regards to the new high in the US, have a read of this.

We'll probably be stuck in this trading range for a while unless the likes of NAB, ANZ and WBC get off the a$$e$ and start rising.

- Joined

- 3 April 2007

- Posts

- 124

- Reactions

- 0

Re: XAO Analysis

I second your wish about the banks getting off their derrieres.

Being only new to all this, I am still trying to get a picture of what is happening and looking at what has happened in the past to try to understand today's market a bit better (and why my bank shares are down!)

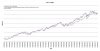

Just for fun I downloaded the three year figures for the XAO and the XFJ, then adjusted the figures of the XAO by deducting the difference at the starting point from each figure so that the two lines matched up at the start. This shows the way the two indices have moved relative to each other over the last three years.

I downloaded the three year figures for the XAO and the XFJ, then adjusted the figures of the XAO by deducting the difference at the starting point from each figure so that the two lines matched up at the start. This shows the way the two indices have moved relative to each other over the last three years.

This is what it looks like and underneath is one with the XMJ added in and the same manipulation done (ie adjusting figures to give them the same starting point and then adjusting each figure with the same amount).

In the actual scheme of things it's probably not too startling. However, having them superimposed really shows the input onto the XAO the resources boom has made.

It's the only thing that is keeping the XAO in positive territory and really demonstrates Uncle Festivus's comments above.

I suppose if there is only a finite money to be invested, they have to take it out of somewhere to put it into resources and the financials are obviously the ones that are suffering because of it.

I second your wish about the banks getting off their derrieres.

Being only new to all this, I am still trying to get a picture of what is happening and looking at what has happened in the past to try to understand today's market a bit better (and why my bank shares are down!)

Just for fun

This is what it looks like and underneath is one with the XMJ added in and the same manipulation done (ie adjusting figures to give them the same starting point and then adjusting each figure with the same amount).

In the actual scheme of things it's probably not too startling. However, having them superimposed really shows the input onto the XAO the resources boom has made.

It's the only thing that is keeping the XAO in positive territory and really demonstrates Uncle Festivus's comments above.

I suppose if there is only a finite money to be invested, they have to take it out of somewhere to put it into resources and the financials are obviously the ones that are suffering because of it.

Attachments

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

Re: XAO Analysis

Ozambersand

Just because XMJ is at 14000 that does not mean it is 'worth' more than the XFJ at 7500.

Is the y-axis of your charts a point change or percentage comparison? If it is points moved I'm not sure that will make a lot of sense as far as showing anything. As the materials index is at 14000 and the Financials at 7000 but the financials are twice the market capitalization. That is why the XFJ is so important to the movement of the XJO/XAO being a market cap weighted index.

Since three years ago the XMJ has gone from 7000 to 14000 about 100% gain, while the XFJ has gone from 4500 to 7500 about 66% gain, but since the market cap of XFJ is twice that of XMJ it has had a far greater effect on the market indices.

I second your wish about the banks getting off their derrieres.

Being only new to all this, I am still trying to get a picture of what is happening and looking at what has happened in the past to try to understand today's market a bit better (and why my bank shares are down!)

Just for funI downloaded the three year figures for the XAO and the XFJ, then adjusted the figures of the XAO by deducting the difference at the starting point from each figure so that the two lines matched up at the start. This shows the way the two indices have moved relative to each other over the last three years.

This is what it looks like and underneath is one with the XMJ added in and the same manipulation done (ie adjusting figures to give them the same starting point and then adjusting each figure with the same amount).

In the actual scheme of things it's probably not too startling. However, having them superimposed really shows the input onto the XAO the resources boom has made.

It's the only thing that is keeping the XAO in positive territory and really demonstrates Uncle Festivus's comments above.

I suppose if there is only a finite money to be invested, they have to take it out of somewhere to put it into resources and the financials are obviously the ones that are suffering because of it.

Ozambersand

Just because XMJ is at 14000 that does not mean it is 'worth' more than the XFJ at 7500.

Is the y-axis of your charts a point change or percentage comparison? If it is points moved I'm not sure that will make a lot of sense as far as showing anything. As the materials index is at 14000 and the Financials at 7000 but the financials are twice the market capitalization. That is why the XFJ is so important to the movement of the XJO/XAO being a market cap weighted index.

Since three years ago the XMJ has gone from 7000 to 14000 about 100% gain, while the XFJ has gone from 4500 to 7500 about 66% gain, but since the market cap of XFJ is twice that of XMJ it has had a far greater effect on the market indices.

- Joined

- 3 April 2007

- Posts

- 124

- Reactions

- 0

Re: XAO Analysis

Thanks for comments. I take on board your points. I still have a lot to learn about indices and the figures they quote.

What I am trying to show is how the market capitalisation of the two have varied over time and how their percentage of the XAO total market capitalisation has changed.

I understand now that the fact that the market capitalisation of the financials is so much more than the resources will mean that a 10% growth in financials looks less than a 30% growth in resources as the starting figures are so different, when in fact it could be the same amount of capital.

Is there any way we can show this?

Ideally it would be good to look at it with the areas underneath coloured so that you could see the change in the contribution to the total market capitalisation over time for the different sectors.

This time I have done the left axis as percentage growth from the start point from each index on the same day. Is this any better? I created the charts by downloading the index figures from Commsec. If there are places where you can see the variance in actual total market capitalisation for the sectors over time I would be interested in seeing those.

It wasn't meant to be too serious, just trying to illustrate the fact that the only reason the XAO is fairly steady while the XFJ's has been going down is because of the dramatic rise in the resources index.

Thanks for comments. I take on board your points. I still have a lot to learn about indices and the figures they quote.

What I am trying to show is how the market capitalisation of the two have varied over time and how their percentage of the XAO total market capitalisation has changed.

I understand now that the fact that the market capitalisation of the financials is so much more than the resources will mean that a 10% growth in financials looks less than a 30% growth in resources as the starting figures are so different, when in fact it could be the same amount of capital.

Is there any way we can show this?

Ideally it would be good to look at it with the areas underneath coloured so that you could see the change in the contribution to the total market capitalisation over time for the different sectors.

This time I have done the left axis as percentage growth from the start point from each index on the same day. Is this any better? I created the charts by downloading the index figures from Commsec. If there are places where you can see the variance in actual total market capitalisation for the sectors over time I would be interested in seeing those.

It wasn't meant to be too serious, just trying to illustrate the fact that the only reason the XAO is fairly steady while the XFJ's has been going down is because of the dramatic rise in the resources index.

Attachments

- Joined

- 23 October 2005

- Posts

- 859

- Reactions

- 0

Re: XAO Analysis

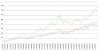

Thanks halcheln, very interesting and unique analysis there, will be interesting to see what happens. Have attached my take/intepreatation of the current pattern of the trend in the DJI

Cheers

I'd have to agree with that.

In regards to the new high in the US, have a read of this.

We'll probably be stuck in this trading range for a while unless the likes of NAB, ANZ and WBC get off the a$$e$ and start rising.

Thanks halcheln, very interesting and unique analysis there, will be interesting to see what happens. Have attached my take/intepreatation of the current pattern of the trend in the DJI

Cheers

Attachments

>Apocalypto<

20.03.2012

- Joined

- 2 February 2007

- Posts

- 2,233

- Reactions

- 2

Re: XAO Analysis

Wavepicker

I think your analysis is right on the money. Thanks for posting your chart great stuff.

There are problems with the magic number of 6400 on the xjo and for the highs set on the all ords as well.

Whether on not the dow rises or falls does not as you have all seen off the last 4 days tell us that we will follow into blue sky's. If you want a example see the charts of both indexes this time last year the dow broke out in july we banded till September.

I am also with wavepicker now thinking we will stay in this band. We have had lots of good reasons to bust out. The buyer confidence at the current time just aint there.

So back to the side lines for me right now on my xjo trades.

Wavepicker

I think your analysis is right on the money. Thanks for posting your chart great stuff.

There are problems with the magic number of 6400 on the xjo and for the highs set on the all ords as well.

Whether on not the dow rises or falls does not as you have all seen off the last 4 days tell us that we will follow into blue sky's. If you want a example see the charts of both indexes this time last year the dow broke out in july we banded till September.

I am also with wavepicker now thinking we will stay in this band. We have had lots of good reasons to bust out. The buyer confidence at the current time just aint there.

So back to the side lines for me right now on my xjo trades.

Similar threads

- Replies

- 31

- Views

- 4K

- Replies

- 141

- Views

- 34K

- Replies

- 9

- Views

- 5K

- Replies

- 22

- Views

- 15K