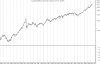

Re: XAO Analysis

I knew when I made the comment that you’d probably respond – not detracting from your informative posts, but seeing MAs used in your analysis twigged a motivation to comment...

I think you are missing my point I have raised in many posts before: In my view, moving averages actually obscure the chartist/analyst from seeing much of what is going on in the market. As McLaren said, it’s trading “shadows against a wall”.

Looking backwards won’t alert you to patterns suggesting a probability of a change in trend. If you do this, you won’t see the cliff, or the spring board. A lot of course depends on the time frame you are trading/investing in. Basic MAs can help for the long term (as tech has done with techtrader).

Anyway, my comments were about using MAs to predict where and when a potential crash/correction would be actually. You were using the 200 day moving average as the basis for that analysis. My response was that a blow off trend can fool a moving average system, even a long term one. They aren’t a forecasting tool, and have in my view negative effects to chart analysis (as much as some rudimentary ones to try to keep you on the right side of the trend. But they obscure counter trends, false breaks, exhaustions etc. I’m sure you ‘d agree with this, wouldn’t you?

As for forecasts, actually, I have made a range of forecasts on this site, as you know – there are some that are current right now, so yes, I have said some things that are new if you were looking... What I’m saying now is, yup there are patterns alerting us to the potential for a correction of some sort, the problem is when. I’m saying, I can’t tell you when the correction is likely to happen right now, but what I can say is I don’t think it’s likely at least until the middle of July. How the market trades into that point will let me make forecasts with much more certainty.

What you need to grasp is that the forecasting style hinges on key “choke” or “tipping” points where outcomes that are in the balance can have major effects into the future, and identifying them and utilising them. It’s like one of those SciFi movies where they go back in time and stuff something up, and the future changes (you know the time line idea – Bradbury did an early version of this about shooting dinosaurs in the past, and one guy treads on an ancient moth, and changes the present as a result).

I look at it this way, the charts of the future are not yet written. I do not believe in a deterministic universe, or a deterministic market. But I am swayed by chaos models, and the idea of estimating probabilities, and deciphering market patterns. I do believer that there is an inherent order to markets, and that if you look at the market the right way there are a host of clues that give you a significant edge that are unorthodox. So, in my view, moving averages and oscillators are misused by the majority, and in many cases actually obscure the aspiring technical analyst from really seeing the market.

By the way, I do have some really long range forecasts, but I’m not going to post these on a public forum, especially when there are so many possibilities that can intervene in the interim, but some in their original form survive and work like a charm.... the majority though can be right in time or price, but often not both. Hence I only post up shorter range forecasts which are easier to grasp, rather than a full campaign map... who’d read it anyway?

Regards

Magdoran

Hello TAG,With regards to accounting for lag, you are probably right. There could be another dimension added to this analysis that accounts for lag using rate-of-change or some other measure to quantify how strongly the index is pulling away from its moving average. And perhaps a better moving average could have been chosen, like an exponential. And with regards to being "rough", again, yes, you are probably right. But for those who are reading this and wondering if moving averages are a useless indicator and ought to be immediately ditched in exchange for something more sophisticated or refined, a balanced answer should include reference to those people who use something as "fundamentally flawed" as an average in their trading and continue to make profits.

To quote Ed Seykota's site (http://www.seykota.com):

"A trend is a general drift or tendency in a set of data. All measurements of trend involve taking a current reading and a historical reading and comparing them. If the current reading is higher than the historical reading, we have an up-trend. If lower, we have a down-trend. In the improbable event of an exact match, we have a sideways trend."

Using a moving average can be a simple, visual way of determining if you have a trend, how far that trend has moved over a period of time and how far away it is from a reference point. Its simple and effective. You could say my preference is to be "The Beatles" in my analysis, rather than say, Stevie Ray Vaughan or Tommy Emmanuel. Or as Miles Davis would put it, "I always listen to what I can leave out,". I'm keen to eliminate that which seems superfluous.

The use of the MAs on a market that has shown patterns in its trending for the last 4 years can be a form of adaptive analysis. Think of it like a blue print for a trading system that has a set of paramaters determined from back testing on a large body of historical data. If the market steps outside of the parameters of that blue print then it suggests we are in uncharted territory. Time to find a system, or in my case, a new reference model. Markets are always the same in that they're always changing. We know this.

When we discuss a good trading system that uses moving averages getting you in and out at the wrong time, we're probably refering to whip-sawing, right?? Its real, it exists, and its part of trading. Moving averages can be used effectively in trend following systems that rely on high R multiple trades to offset the +/-1R trades that occur during whip-saws or false positives or whatever you want to call them. For this reason systems such as this can often be "wrong" more than 50% of the time. We should not confuse being right with being profitable. They're two different needs. Given enough time a trader will adopt a system which suits his/her needs and personality.

My analysis is backward looking. And it will always lag the market, as I am using purely price as an indicator of price. I don't pretend to be able to see beyond the last bar on the chart and I don't need to be "right". Hunches are good enough. What I can tell you is when price is behaving differently in this move than what it has done previously, the signficance of that is up to each of us to weigh.

This doesn't really tell us anything new. I remember going to numerous market presentations around 2001/02 and being told by suited-up "experts" what to expect. Single digit returns for the remainder of the decade was bandied around repeatedly. Nobody saw this bull market coming, nobody saw the duration or strength that it has shown and nobody will see its end. If you are going to forecast, forecast often...isn't that how the saying goes??

I knew when I made the comment that you’d probably respond – not detracting from your informative posts, but seeing MAs used in your analysis twigged a motivation to comment...

I think you are missing my point I have raised in many posts before: In my view, moving averages actually obscure the chartist/analyst from seeing much of what is going on in the market. As McLaren said, it’s trading “shadows against a wall”.

Looking backwards won’t alert you to patterns suggesting a probability of a change in trend. If you do this, you won’t see the cliff, or the spring board. A lot of course depends on the time frame you are trading/investing in. Basic MAs can help for the long term (as tech has done with techtrader).

Anyway, my comments were about using MAs to predict where and when a potential crash/correction would be actually. You were using the 200 day moving average as the basis for that analysis. My response was that a blow off trend can fool a moving average system, even a long term one. They aren’t a forecasting tool, and have in my view negative effects to chart analysis (as much as some rudimentary ones to try to keep you on the right side of the trend. But they obscure counter trends, false breaks, exhaustions etc. I’m sure you ‘d agree with this, wouldn’t you?

As for forecasts, actually, I have made a range of forecasts on this site, as you know – there are some that are current right now, so yes, I have said some things that are new if you were looking... What I’m saying now is, yup there are patterns alerting us to the potential for a correction of some sort, the problem is when. I’m saying, I can’t tell you when the correction is likely to happen right now, but what I can say is I don’t think it’s likely at least until the middle of July. How the market trades into that point will let me make forecasts with much more certainty.

What you need to grasp is that the forecasting style hinges on key “choke” or “tipping” points where outcomes that are in the balance can have major effects into the future, and identifying them and utilising them. It’s like one of those SciFi movies where they go back in time and stuff something up, and the future changes (you know the time line idea – Bradbury did an early version of this about shooting dinosaurs in the past, and one guy treads on an ancient moth, and changes the present as a result).

I look at it this way, the charts of the future are not yet written. I do not believe in a deterministic universe, or a deterministic market. But I am swayed by chaos models, and the idea of estimating probabilities, and deciphering market patterns. I do believer that there is an inherent order to markets, and that if you look at the market the right way there are a host of clues that give you a significant edge that are unorthodox. So, in my view, moving averages and oscillators are misused by the majority, and in many cases actually obscure the aspiring technical analyst from really seeing the market.

By the way, I do have some really long range forecasts, but I’m not going to post these on a public forum, especially when there are so many possibilities that can intervene in the interim, but some in their original form survive and work like a charm.... the majority though can be right in time or price, but often not both. Hence I only post up shorter range forecasts which are easier to grasp, rather than a full campaign map... who’d read it anyway?

Regards

Magdoran