Whiskers

It's a small world

- Joined

- 21 August 2007

- Posts

- 3,266

- Reactions

- 1

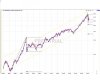

Re: XAO Analysis

People are naturally optimistic, MRC. A lack of unexpected bad news for a reasonable time will allow oportunistic buying to develop.

Love to see around 5,720/30 or so today or tomorow before running out of steam this time to improve probability of a shot well over 6,000 next run up.

Cant be much more room to move upwards, without positive news, especially in relation to company profits.

People are naturally optimistic, MRC. A lack of unexpected bad news for a reasonable time will allow oportunistic buying to develop.

Love to see around 5,720/30 or so today or tomorow before running out of steam this time to improve probability of a shot well over 6,000 next run up.