- Joined

- 1 October 2008

- Posts

- 3,733

- Reactions

- 395

Quick! Start talking about facebook.

I wouldn't fight all this cash.

BUT

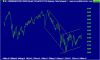

The setup from here seems like we have a high on the open from yesterday and a low from 30 mins ago for the week for all markets Equity, Commods & FX. (Aussie & Euro equity reverse times for H L)

I would play the week ending as a breakout week if we can move and hold past the current set H/Ls by tomorrow. That is take out the lows soon, by Friday we will be much lower. Or reverse come Friday if we can push through the highs.

Now where is that fence?

Huh?

So what I'm saying a little cynically is - the media and anal_ists should now start reving it up if they want the SP500 to smash through to new highs since the crash - and make the market!

I've noticed this relative under performance as well. I see one factor being a sense of creeping sovereign risk from a set of federal policies on the cusp of introduction. More than adequately canvassed on the political threads - with a variety of differing opinions therein. Another factor is that our market index is heavily influenced by commodities and metals companies, which were hit hard last year.

I'm leaning more to the impact of the rising Aud$ discouraging foreign investment in our share market. Potential foreign investors would be apprehensive that a fall in our dollar would have the ability to undermine their investment far more than they would gain through share price gains, divs etc.

A strong dollar in its self shouldn't hold back foreign money when there is a sea of liquidity looking for return. If you are a hedge fund with a spare $2 bil borrowed at close to nothing looking for return the ASX would only be a bad place if you thought the high dollar was not going to last. These dudes chase big trends.

If you invest in XJO @ AUD 1.06 is no real difference than AUD @ $0.80. Its what happens after you get in. If they think AUD is going to $1.12-$1.15 then XJO @ 4300 is a bargain. So far it would seem the double risk of currency at these levels and small liquidity equity markets is unattractive.

Can anyone out there give me the seasonal stats for the XAO?

I'm curious with the March dividend season what the typical March return is.

Thanks.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.