- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

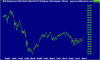

Market looking amazing today. There's about 20 speccies I'd happily buy.

I reckon a few days of slight weakness early next week, then it's on. Breakout time.

I reckon a few days of slight weakness early next week, then it's on. Breakout time.