- Joined

- 28 October 2008

- Posts

- 8,609

- Reactions

- 39

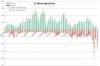

After a frisky pussy yesterday and a 4% hike in the DJIA last night, there's not much "meow" in the cat today.

It kind of reminds me of what happened in the following two days after the week global markets crashed in October 2008.

It kind of reminds me of what happened in the following two days after the week global markets crashed in October 2008.