- Joined

- 27 February 2008

- Posts

- 4,670

- Reactions

- 10

G'day gero.

Your abscence from chat is noticable. I hope your building project is going well.

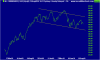

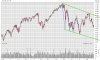

Like you I think we will see another correction. But it may be delayed while the market bounces through the reporting season.

Once that is out of the way, it will be back to the reality of sovereign debt problems overhanging the market.

Hey Nulla,

will try and get back into the chatroom sometime soon as miss the banter with you guys whilst trading......... been flatout m8... building dips and jumps and allsorts of thankless goodies for the young bloke

My opinion is merely based on a technical opinion but yes theres many fundamental factors swinging its hips now .