- Joined

- 14 February 2005

- Posts

- 15,393

- Reactions

- 17,821

No worries, I'll post some more......@Smurf1976 Thanks for sharing a bit more info re your investing strategy. I loved that post.

Currently holding shares in 12 companies (trading ASX listed shares only). 3 are large caps, 3 are mid cap, 6 are small cap.

At present levels 4 of those 12 are a Buy, two of them having an extremely strong signal there, 7 are a Hold and 1 triggered a Sell signal on Friday which will be actioned on Monday.

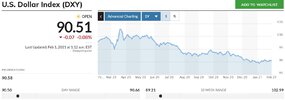

Still long the S&P 500 and short the ASX via ETF's.

As a bit more analysis, comparing the market leading up to August 14 versus the market over the past 4 weeks:

Prior to 14 August:

*Around 25 directly held shares with some minor fluctuation around that number. This was around 12 large cap, 8 mid cap, 5 small cap with some minor variance over time.

*Long the S&P 500 via an ETF

*Long the ASX via a fund

Since 14 August:

*Mid caps were exited first. Buy signals dried up and Sells triggered.

*ASX fund sold next and short position taken.

*Large caps then exited. Buy signals had already dried up, now Sells triggered.

*Nothing has changed regarding small caps and the S&P 500 ETF in terms of Buy / Sell triggers.

My point isn't so much about my trading as the underlying market. A change occurred mid-August that was quite noticeable and thus far it's still present.

In terms of my own trading though, well total account balance is presently down 1.27% from the all time high. Not ideal but could be worse.

Last edited: