over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,553

- Reactions

- 8,149

Yeah, we can lose our money in air conditioned comfort.

Indeed - start looking at charts of stocks individually, one at a time just going through the top 200 or 300 or whatever and taking a brief look at each, and there's plenty of weakness out there.The XAO would be much weaker but the banks are holding it up.

The small ords recovered most of the lost ground yesterday (Edit: against XAO), hope you faired well.I had a bloody week so far, yesterday portfolio of systems shares down 2.5% on a supposedly flat day. WTF?

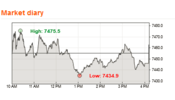

Then looked at small caps index...

View attachment 141258

Well that explains...

If you want crazy stuff look at AUD vs USD following US jumping rate by twice the Aussie version...

I give up trying to find any sense...

Yes did very well yesterday but will be snashed again ...and more today......The small ords recovered most of the lost ground yesterday (Edit: against XAO), hope you faired well.

Looks like today might be a blood bath though.

portfolio falling by 2% today, yet ASS flat..and talk about manipulation of index closing price:Now I know what the boards of AGL and ORG are feeling.

I don't know what's going to happen next and I'm unable to provide any guidance. Today's lithium selloff, ouch.

And this is what I should take as a baseline:Worth noting both @InsvestoBoy's observation and my observation that today's price action seemed like the early signs of exhaustion in the market. Of course I hope the market rally continues unabated next week.

Right now I'm feeling good, really g-o-o-d. There are three reasons for that. Firstly I'm in good physical condition. I pulled up a bit sore this morning after nine sets of tennis yesterday. After an afternoon walk all the soreness is gone and I'm in good shape.

Secondly I just finished a very satisfying meal. It started with a good garlic bread, a great red wine that went down smoothly. Then to top it off I got a perfect pizza. It's not often this happens, but tonight the toppings were plentiful and tasty. What made this pizza perfect was the base, not crispy not doughy but just right. A tasty gelato at the end had me in raptures.

Thirdly, aren't we enjoying this market rally. I'm having my best start of any FY. I know it's not me. I haven't turned into a trading god yet. The market rally started at the same time as the new FY. Serendipity. I'm remember something that @frugal.rock mentioned. Whenever we hit a new equity high we should liquidate. Me and the market aren't at a new high yet but the idea to be careful when things seem to be going perfectly well is valid.

What is happening and what's the likely forward outcome?

We know that seven companies dominate our index. It's the banks that have underpinned this rally. BHP, RIO and TLS haven't contributed much at all. However it's the underlying bullish breadth of the market that has this rally moving smoothly. The small ords, midcaps and all battery mineral resources have contributed substantially to this rally.

Going forward, the banks will continue to do well in this rising interest rate environment. They'll be able to increase their margins. Bad debts won't be a problem until the interest rates get much higher as a significant percentage of customers are ahead in their mortgage payments. The outlook for BHP, RIO depends on the iron ore price, China must eventually restart their economy. They do have problems with their Covid policy (lockdowns) and Evergrande. Their current focus on Taiwan and Aust are distractions from their internal problems. I can't see BHP and RIO going down significantly although they may not increase for a while. I'm bullish the rest of our market. We do have a problem with the lack of skilled labour. Companies will adapt and I think the outlook is promising because the growth will be slow and steady rather than fast and frothy.

I'm bullish XAO as I see the index rising in a slow and steady manner. The only problem that would hamper our market is the US. They will get into a harder recession than Aust and currently their political system is imploding. This has the potential to fuel violent civil unrest.

Relative Strength to the XAO (21d) : Mid caps > Small caps > Large caps

View attachment 145331

Ah yes but under different market conditions how do those two losers perform?5 systems: since FY start:

1 roughly flat, 2 winning, 2 losing => I should really interpret that as I need to drop the 2 losers

They obviously should be ?as they were developed using backtests,shaken by adding random input but conceptually, i do not understand how they should deviate from the overall market conditions.Ah yes but under different market conditions how do those two losers perform?

They might actually be profitable over the long term?

Frog, what style is the the system and what part of the ASX does it trade?They obviously should be ?as they were developed using backtests,shaken by adding random input but conceptually, i do not understand how they should deviate from the overall market conditions.

until i do, there is an issue.

I tend to sort this dilemma by reducing exposure aka slash parcel value by 2 until i can understand how the money is lost..but that trouble shoting is a priority.

The xnt has gained back its January 22 level, and a system not matching this performance in the last 8 months has an issue IMHO.so i act.

To get back into this thread, i consider the XNT a better baseline for traders than the XAO as we need to ensure that our buy sell sagas is worth the missed dividends of the banks BHP etc etc

The two losers are break out attempts, with purposedly quick in out play, low latency to get in out, realm from memory on the whole xao.Frog, what style is the the system and what part of the ASX does it trade?

Serendipity.

That sounds like illogical, contrarian, irrational and chaos based reasoning.Whenever we hit a new equity high we should liquidate. Me and the market aren't at a new high yet but the idea to be careful when things seem to be going perfectly well is valid.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.