white_goodman

BOC

- Joined

- 13 December 2007

- Posts

- 1,635

- Reactions

- 0

A piece showing differences between Bernanke the Chairman and Bernanke as the academic

http://thefaintofheart.wordpress.com/2013/05/10/bernanke-has-not-listened-to-bernanke/

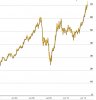

How are those big short positions going Festivus?

http://thefaintofheart.wordpress.com/2013/05/10/bernanke-has-not-listened-to-bernanke/

How are those big short positions going Festivus?