I wouldnt short defensive stocks in a hope that when the market tanks they will cover your longs, because those longs will go down alot harder and alot faster then CSL or TLS.

I don't hope anything.

I just trade the chart as the setups come along.

If you want to contribute some thoughts that would be great.

Until then, I will be sitting here quietly trading the plan posted each day before the market opens.

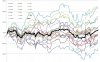

So far from a forex perspective, I have had absolutely no issues trading each individual setup on each individual chart and IGNORING the market bias. If I was paying attention to market bias I would've missed the awesome play that has been happening for weeks now: long comdolls short Eurozone, USD neutral. Because I probably would've been flip flopping between USD bearish and bullish and losing money like all the other idiots on forexfactory who are looking at the EURUSD chart to short AUDUSD.

What a rubbish way to trade.