MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

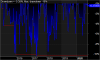

Weekly at this stage. You can see from the sims that it halved the March DD to around 8-9% which is pretty respectable and something I can live with. I’m definitely interested in doing a daily check as you suggest, but haven’t had time to code and sim yet, but I will do.Do you check that 4.5% fall daily or weekly.

If you do the check weekly, are you not at the mercy of timing?

And should you not do a daily check similar to:

Exit all if fall on the last n session is above xx %?