The big will get bigger and fatter, the small man will be reduced to a skeleton, but the latter don't know that yet.It's swings and roundabouts, a major transformation in US manufacturing is just all electoral talk, he'll free up corporate taxes, and business will prosper. You watch if he gets in, he'll help all his buddies in big business.

What's crippling the world ATM, is its energy prices because everyone wants to go green energy.

I'm not a big fan of Trump but It's just market manipulation by the big boys.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tomorrow's trading on the ASX?

- Thread starter farmerge

- Start date

-

- Tags

- asx tomorrow's market trading

- Joined

- 15 June 2023

- Posts

- 1,168

- Reactions

- 2,550

Out of all the people in the US surely they could have found better candidates for both sides.yes , despite i have my areas of disagreement , i would like to have seen the US citizens given a real view of RFK jr as a choice

would he have been different enough , who knows

but personally i will still be focusing my international investments on Asia ( with a reduced focus on China and Japan ) , NZ ( only a small puddle but easy to buy dominant market share ) with a watchful eye for opportunities in Africa and PNG

BTW i class India as part of Asia

but the BIG corporations ( and donors ) have controlled the major Western parties for decades

little will change until voters vote with their wallets ( boycott , reduce spending etc etc etc )

- Joined

- 15 June 2023

- Posts

- 1,168

- Reactions

- 2,550

Much like Australia hey.The big will get bigger and fatter, the small man will be reduced to a skeleton, but the latter don't know that yet.

Yes, so that brings about another topic....how do we educate the populace? The 'blind' cannot see, stuck in our views and belief, we cannot shift gear, same as trading and investing...the flexible and adaptable are the ones who will survive (this is more suitable for another thread, so let's leave it at that, gone off topic)

- Joined

- 15 June 2023

- Posts

- 1,168

- Reactions

- 2,550

It's why I don't believe the narrative that the stock markets will severely fall under Trump, it's only the Bloomburgs and G&Ss sounding their megaphones and fear mongering everyone in the echo chambers.yes but those increases will create more actual ( not government ) jobs and inflation because the ( actual ) economy is growing

i consider that 'healthy growth '; unlike the current pattern

also it should be better for small and medium businesses

and anyway the US stock market seems to be just 10 giant corporations they had to come back to realistic valuations eventually

Businesses make more profits, more jobs, more dividends, and higher SPs

That's what investing is all about.

We're more connected to the US stockmarket than many believe or shall I say controlled, their institutional investors make ours look like ants in value.

Just take for e.g. when they pulled out of FMG.

DYOR

- Joined

- 20 July 2021

- Posts

- 11,725

- Reactions

- 16,351

depends on what YOU call betterOut of all the people in the US surely they could have found better candidates for both sides.

what most nations need is a Statesman/woman , aka a real leader with the nation's interest at heart , but what you normally get is a politician with the party's ( and donors ) best interest at heart

any upstart usually gets smashed by the large media corporations because they are driven by ad revenue

the fact they crushed any internal rivals to Biden said it all , and well Trump got there because nobody else could raise enough cash using their own persona ( half the Republican party would have disappointed the bullet missed , they want the power but don't have the charisma )

now if Musk had of been born in the USA .... would that have been an interesting scenario ( i am no fan of Musk , but i do respect his achievements )

- Joined

- 20 July 2021

- Posts

- 11,725

- Reactions

- 16,351

should Trump be elected , i would expect a more robust US economy ( and stock market ) not a market rising or falling on the fate of seven or eight stocks AND should be a great time for value investors to scoop up under-valued stocks with solid growth potentialIt's why I don't believe the narrative that the stock markets will severely fall under Trump, it's only the Bloomburgs and G&Ss sounding their megaphones and fear mongering everyone in the echo chambers.

Businesses make more profits, more jobs, more dividends, and higher SPs

That's what investing is all about.

We're more connected to the US stockmarket than many believe or shall I say controlled, their institutional investors make ours look like ants in value.

Just take for e.g. when they pulled out of FMG.

DYOR

somebody has a lot of cash in the short-term money markets , that might find it's way into the S&P 500 and Russell 2000 in 2025

Hang Seng | 17,750.00 | 17,877.50 | 17,706.00 | -265.94 | -1.48% | 01:23:51 |

Dona Ferentes

Pengurus pengatur

- Joined

- 11 January 2016

- Posts

- 16,351

- Reactions

- 22,327

The S&P/ASX 200 closed 18.3 points lower, down 0.23%.

The biggest news / move of the day was undoubtedly Droneshield (ASX: DRO). It rose to a new high of $2.72 at the open only to plunge over 34% to $1.79 just before it went into a trading halt

.

www.marketindex.com.au

www.marketindex.com.au

The biggest news / move of the day was undoubtedly Droneshield (ASX: DRO). It rose to a new high of $2.72 at the open only to plunge over 34% to $1.79 just before it went into a trading halt

.

Evening Wrap: ASX 200 dips on faltering mining stocks, Droneshield shot down on short seller report

Resources and mining stocks dragged the index lower, but there were some stellar gains in small-cap resources. Droneshield was shot down on a short seller report.

- Joined

- 14 February 2005

- Posts

- 15,307

- Reactions

- 17,550

Where that gets complex is short term versus long term.i expect Trump to put on more tariffs on selected imported goods ( which is still a stealth tax on consumers )

sure it might help ambitious US manufacturing and industry , but the consumer will still feel it in the wallet

Short term it's inflationary I agree.

Long term though domestic production is an alternative to inflation, it's an alternative to the printing press economy to instead be producing real goods and services.

So for the market impact, short term it ought be inflationary but it's different for those looking for long term buy and hold investments.

This doesn't seem the right thread for long term macro stuff though so I'll avoid any further details.

Last edited:

- Joined

- 21 August 2008

- Posts

- 2,831

- Reactions

- 8,769

Market Index - Wednesday Morning Wrap

ASX 200 futures are trading 55 points higher, up 0.68% as of 8:30 am AEST.

Ooft. What a spicy overnight session. The S&P 500, Dow and Nasdaq all closed at record levels while the small-cap Russell 2000 surged 3.5%. At the same time, gold hit a fresh all-time high and traders are almost certain that the Fed will cut rates in September.

Let's dive in.

www.marketindex.com.au

www.marketindex.com.au

ASX 200 futures are trading 55 points higher, up 0.68% as of 8:30 am AEST.

Ooft. What a spicy overnight session. The S&P 500, Dow and Nasdaq all closed at record levels while the small-cap Russell 2000 surged 3.5%. At the same time, gold hit a fresh all-time high and traders are almost certain that the Fed will cut rates in September.

Let's dive in.

Morning Wrap: ASX 200 to open at record highs, Russell 2000 jumps 3%, Gold prices surge

ASX 200 futures are trading 55 points higher, up 0.68% as of 8:30 am AEST.

Dona Ferentes

Pengurus pengatur

- Joined

- 11 January 2016

- Posts

- 16,351

- Reactions

- 22,327

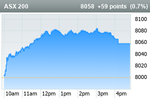

woohoo.. records a-plenty.. New highs. 8000 for ASX200 index

The S&P/ASX 200 closed 58.6 points higher, up 0.73%.

- Gold stocks were the best performing stocks today, as gold prices tipped new highs, but there were also very strong performances from Property, Technology, and Financials stocks.

- Worryingly, key mining stocks sold off on sharp losses in base metals and other key commodity prices

www.marketindex.com.au

www.marketindex.com.au

The S&P/ASX 200 closed 58.6 points higher, up 0.73%.

- Gold stocks were the best performing stocks today, as gold prices tipped new highs, but there were also very strong performances from Property, Technology, and Financials stocks.

- Worryingly, key mining stocks sold off on sharp losses in base metals and other key commodity prices

Evening Wrap: ASX 200 surges to record on gold, property, tech, as mining stocks falter, Droneshield blitzed again

Gold stocks were the best performing stocks today, as gold prices tipped new highs, but there were also very strong performances from Property, Technology, and Financials stocks. Worryingly, key mining stocks sold off on sharp losses in base metals and other key commodity prices. Hot stock...

- Joined

- 21 August 2008

- Posts

- 2,831

- Reactions

- 8,769

Market Index - Thursday Morning Wrap

ASX 200 futures are trading 43 points lower, down -0.53% as of 8:30 am AEST.

The Dow closed at a fresh all-time high while the S&P 500 and Nasdaq sold off sharply, the Russell 2000 briefly traded at its most overbought point in history, UK inflation remained at the Bank of England's 2% target in June and expect a pretty choppy session for local equities.

Let's dive in.

www.marketindex.com.au

www.marketindex.com.au

Which includes your favourite piece @eskys

ASX 200 futures are trading 43 points lower, down -0.53% as of 8:30 am AEST.

The Dow closed at a fresh all-time high while the S&P 500 and Nasdaq sold off sharply, the Russell 2000 briefly traded at its most overbought point in history, UK inflation remained at the Bank of England's 2% target in June and expect a pretty choppy session for local equities.

Let's dive in.

Morning Wrap: ASX 200 to fall, Nasdaq posts worst day since December 2022, blue-chip Dow extends gains

ASX 200 futures are trading 43 points lower, down -0.53% as of 8:30 am AEST.

Which includes your favourite piece @eskys

- Joined

- 5 August 2021

- Posts

- 363

- Reactions

- 796

The Uranium reversal hurts,

Interesting that the ASX ended up opening pretty much flat with futures so low going into the open seems we could end up with a green day. Wonder if real estate will carry us over the line.

Interesting that the ASX ended up opening pretty much flat with futures so low going into the open seems we could end up with a green day. Wonder if real estate will carry us over the line.

Anything is possible, Bossman.

Reits have run well lately, 2 green in the large caps, half a dozen green in mid cap. The most greens are in small caps, tinge of green. Overall sector down .44%

I don't know where they're heading...I'm out and that could be a mistake

Reits have run well lately, 2 green in the large caps, half a dozen green in mid cap. The most greens are in small caps, tinge of green. Overall sector down .44%

I don't know where they're heading...I'm out and that could be a mistake

- Joined

- 21 August 2008

- Posts

- 2,831

- Reactions

- 8,769

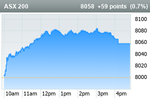

Market Index - Thursday Evening Wrap

The S&P/ASX 200 closed 21.4 points lower, down 0.27%.

There's an old saying that when the US stock market sneezes, the Aussie share market catches a cold.

Well, US tech stocks sneezed (um, sneezed and keeled over) last night, so you can guess what happened to Aussie tech stocks today.

Let's dive in!

www.marketindex.com.au

www.marketindex.com.au

The S&P/ASX 200 closed 21.4 points lower, down 0.27%.

There's an old saying that when the US stock market sneezes, the Aussie share market catches a cold.

Well, US tech stocks sneezed (um, sneezed and keeled over) last night, so you can guess what happened to Aussie tech stocks today.

Let's dive in!

Evening Wrap: ASX 200 slides as local tech stocks crumble on NASDAQ plunge, defensives prosper, uranium stocks dive

There's an old saying that when the US stock market sneezes, the Aussie share market catches a cold. Well, US tech stocks sneezed (um, sneezed and keeled over) last night, so you can guess what happened to Aussie tech stocks today.

- Joined

- 21 August 2008

- Posts

- 2,831

- Reactions

- 8,769

Market Index - Friday Morning Wrap

ASX 200 futures are trading 87 points lower, down 1.09% as of 8:30 am AEST.

Major US benchmarks continued to slip overnight, with the Nasdaq struggling to bounce from its worst session since 2022. The ECB kept rates unchanged as expected, Biden tests positive for Covid, Australian June jobs data tops analysts forecasts and a few broker notes of interest.

Let's dive in.

www.marketindex.com.au

www.marketindex.com.au

ASX 200 futures are trading 87 points lower, down 1.09% as of 8:30 am AEST.

Major US benchmarks continued to slip overnight, with the Nasdaq struggling to bounce from its worst session since 2022. The ECB kept rates unchanged as expected, Biden tests positive for Covid, Australian June jobs data tops analysts forecasts and a few broker notes of interest.

Let's dive in.

Morning Wrap: ASX 200 to tumble, Wall Street pullback accelerates, Small caps retreat

ASX 200 futures are trading 87 points lower, down 1.09% as of 8:30 am AEST.

- Joined

- 15 June 2023

- Posts

- 1,168

- Reactions

- 2,550

If one word could describe today's stock market, it is CARNAGE.

Similar threads

- Replies

- 177

- Views

- 12K

- Replies

- 6

- Views

- 3K

- Replies

- 8

- Views

- 1K

- Replies

- 30

- Views

- 4K

- Replies

- 40

- Views

- 5K