- Joined

- 21 August 2008

- Posts

- 2,831

- Reactions

- 8,769

Market Index - Tuesday Evening Wrap

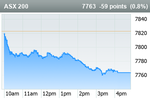

The S&P/ASX 200 closed 32.5 points lower, down 0.42%.

There's a very simple rule in financial markets: Stocks hate rising yields.

And since the middle of last week, both local and overseas benchmark yields have been on the rise. The result is lower prices for Aussie stocks today – particularly those in the Consumer Discretionary, Property, and Financials sectors.

The only sector to show any strength of note was the Energy sector. It's enjoying the potential spoils of rising coal and crude oil prices.

It also likely didn't help matters that minutes from the RBA's June meeting released today demonstrated an all too eager readiness to hike again if required...

Let's dive in!

www.marketindex.com.au

www.marketindex.com.au

The S&P/ASX 200 closed 32.5 points lower, down 0.42%.

There's a very simple rule in financial markets: Stocks hate rising yields.

And since the middle of last week, both local and overseas benchmark yields have been on the rise. The result is lower prices for Aussie stocks today – particularly those in the Consumer Discretionary, Property, and Financials sectors.

The only sector to show any strength of note was the Energy sector. It's enjoying the potential spoils of rising coal and crude oil prices.

It also likely didn't help matters that minutes from the RBA's June meeting released today demonstrated an all too eager readiness to hike again if required...

Let's dive in!

Evening Wrap: ASX 200 stumbles on rising benchmark yields, RBA minutes hint readiness to hike if necessary

Stocks hate rising yields, and since the middle of last week, both local and overseas benchmark yields have been on the rise. The result is lower prices for Aussie stocks today - particularly those in the Consumer Discretionary, Property, and Financials sectors.