I've been trying to develop a system that is scalable, and I'm interested getting some opinions on whether my latest effort fits the bill.

It trades the HSI/SPI futures intraday (always flat at the end of the day). It's systematic and automated, so I just log in at the end of the day and make sure all looks well.

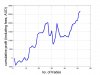

It's been going for 6-weeks now, and below is a summary of the first 50-odd trades.

The key point is that

1) It's profitable; it's turned roughly 30% profit in 6-weeks (2.5k profit, costs about 8k to hold a pair of contracts). This agrees well with backtesting over 2-years of data.

2) Expected value is pretty small - about 8-ticks on the HSI, and negligible on the SPI.

3) Clearly prone to draw downs. I am experimenting with stops to try and minimize these.

Do people have a feel for the limit to the number of contracts that a system like this can take before it is overwhelmed by slippage? I've been trading 2 pairs (numbers in figures are for one pair).

What fraction of capital would you be happy to allocate to a system like this, with good returns but pretty scary drawdowns?

It trades the HSI/SPI futures intraday (always flat at the end of the day). It's systematic and automated, so I just log in at the end of the day and make sure all looks well.

It's been going for 6-weeks now, and below is a summary of the first 50-odd trades.

The key point is that

1) It's profitable; it's turned roughly 30% profit in 6-weeks (2.5k profit, costs about 8k to hold a pair of contracts). This agrees well with backtesting over 2-years of data.

2) Expected value is pretty small - about 8-ticks on the HSI, and negligible on the SPI.

3) Clearly prone to draw downs. I am experimenting with stops to try and minimize these.

Do people have a feel for the limit to the number of contracts that a system like this can take before it is overwhelmed by slippage? I've been trading 2 pairs (numbers in figures are for one pair).

What fraction of capital would you be happy to allocate to a system like this, with good returns but pretty scary drawdowns?