CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

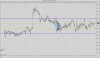

Another range day for the FTSE and the DAX?

I've got the FTSE bracket at 6571/6562 to 6496.5

If we open up in balance 6510 - 6536 will look to fade these areas...

Looks like allot of short inventory at the moment on the TPOs, so be prepared for a short covering rally if we look above the bracket and find buyers....

I've got the FTSE bracket at 6571/6562 to 6496.5

If we open up in balance 6510 - 6536 will look to fade these areas...

Looks like allot of short inventory at the moment on the TPOs, so be prepared for a short covering rally if we look above the bracket and find buyers....

People everywhere....

People everywhere....