CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

ta guys.

so Canoz I gather one of the best uses for this structure is to help you develop with whether we could be looking at a range day (I believe you call them brackets?) or a break out day. interesting

Yeah, determining the day type, balance or imbalanced, makes a big difference in trade opportunities. I've lost count how many times I've been caught fading a trend or trying to buy breakouts in a balanced market. The pace of trade also gives a few clues too with range trade around value being slow and choppy.

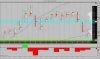

If price is riding up the outside of the standard deviations after an open outside of value, then its not something I'm going to fade until it tests a prior VWAP (VWAP being the center line of the bands) and finds some responsive selling.

The big confluences are used to find the real key areas where significant buying or selling could occur.