- Joined

- 28 March 2006

- Posts

- 3,565

- Reactions

- 1,303

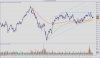

Don't have time to post a chart but the FTSE weekly is really starting to get back up towards the highs. Perhaps a chance to establish a longer term position?

One option ?

(ZU Weekly - click to expand)