CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

Just a quick post in between proofing and baking!

How can a repeating pattern on one market help you on another?

The ES (S&P 500 mini) will frequently test the high or low that was realized during the extended trading or Globex session. This itself is a pattern that many traders use. I saw some figures on it some time ago but it was more than 40% of the time that it was tested within x time from the open of regular trading hours.

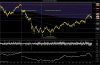

Anyway, on Friday it was tested. I've often noticed that when the ES did its test, there would be a low/high in the European markets. I used to watch the DAX allot, when i picked this up. For those that don't know, the US leads Europe (generally) once the Cash opens in NY. So when the ES tested its Globex low again for the second time after the open, the FESX also tested an important level, 2500. You can see on the FESX chart that it was almost as if the buyers were waiting for a chance to swing into action here....

Now i did not know this before i looked at the FESX chart today as i was watching the ES/CL only on Friday night, but i knew that if the ES tested the O/N low there would be something interesting on the FESX, there almost always is.

Another example of a repeating 'pattern' that offers a trading opportunity.

Here's is the video or the replay. Keep in mind the T&S is not accurate, i think the replay engine is too slow to keep up. The prints on the DOM should be accurate. You can see some absorption at 2501 but mainly just the selling drying up...The bid depth thickens up as well. Anything over 2000 is highlighted.

[video=youtube_share;-JDHFuOlEM0]http://youtu.be/-JDHFuOlEM0[/video]

Cheers,

CanOz

How can a repeating pattern on one market help you on another?

The ES (S&P 500 mini) will frequently test the high or low that was realized during the extended trading or Globex session. This itself is a pattern that many traders use. I saw some figures on it some time ago but it was more than 40% of the time that it was tested within x time from the open of regular trading hours.

Anyway, on Friday it was tested. I've often noticed that when the ES did its test, there would be a low/high in the European markets. I used to watch the DAX allot, when i picked this up. For those that don't know, the US leads Europe (generally) once the Cash opens in NY. So when the ES tested its Globex low again for the second time after the open, the FESX also tested an important level, 2500. You can see on the FESX chart that it was almost as if the buyers were waiting for a chance to swing into action here....

Now i did not know this before i looked at the FESX chart today as i was watching the ES/CL only on Friday night, but i knew that if the ES tested the O/N low there would be something interesting on the FESX, there almost always is.

Another example of a repeating 'pattern' that offers a trading opportunity.

Here's is the video or the replay. Keep in mind the T&S is not accurate, i think the replay engine is too slow to keep up. The prints on the DOM should be accurate. You can see some absorption at 2501 but mainly just the selling drying up...The bid depth thickens up as well. Anything over 2000 is highlighted.

[video=youtube_share;-JDHFuOlEM0]http://youtu.be/-JDHFuOlEM0[/video]

Cheers,

CanOz