CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

All day today I've been testing a new data feed from IQFeed, trying to resolve my connectivity issues once and for all.

I was showing my wife a few ins and outs of the DOM while GC was in pit open and i noticed that the bids and offers were really screwed up, so i switched off the IQFeed and waited for my broker feed to kick in....it wouldn't take over so i manually asked it to disconnect....then NT Told me i still had an open position...ON MY LIVE ACCOUNT....I'm thinking "WHAT FARKING LIVE POSITION?????????

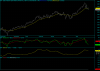

The GC pit opens and GC shoots up 7 points...

I switch over to account view, by this time I've gone white as a sheet and my wife is asking me..."Whats Wrong?"

I said..."I've got a live trade open here somehow"

I look at the P/L...Its June Gold:1zhelp:....then i look again...Its positive....several thousand dollars positive

Moral of the story, always start in simulation mode if you are testing connectivity.

CanOz