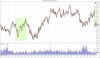

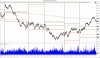

I'm also definitely interested in this thread. Keep it going and don't hold back on the graphs, as the visual example is always the best (this includes you tech/a and everyone else that can provide pattern examples etc).

I have one question also, for yourself or others - Who provides a decent simulated/demo trading account for futures?

I have one question also, for yourself or others - Who provides a decent simulated/demo trading account for futures?