>Apocalypto<

20.03.2012

- Joined

- 2 February 2007

- Posts

- 2,233

- Reactions

- 2

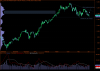

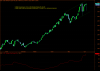

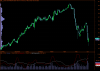

The DAX,

from wanting to quit trading one moment to starting to see some light now. it's a hell of a market and really tests your mental composure. CL had it's moments bu never felt mentally drained as with trying to get somewhere with the DAX.

went through 5 ideas till reaching this point. made brokers a bit of coin while getting cut to sheds most weeks.

think i am finally onto something... but a little early to call a sure thing. I tried 4 different time frames to finally settle on the 1 min. thought about this for a while. 1 min we all hear it's to hard to read and trade. for me atm it's the only time frame i can use with any accuracy. spent a lot of time on 5 min 3 min 2 min thinking the 1 min was a waste of time.

traded live and demo since Dec last year trying and trying to find something. nonstop screen time every day. this post is more a emotional release then anything as my wife thinks i dumb trading and none of my mates would care to hear it all out. sorry ASF you're all i have. I tried and tried on MT4 to trade the DAX but i could never get any ware. I don't think it's possible with MT4. Once i switched to Ninja Trader i started to progress quickly.

I have been using FXCM through NT and thankfully i got trade station to look just like Ninja and I can read it like Ninja. Trading off chart trader is a killa best use it for free with a plug in due to the coms and buying cost. so i was a bit depressed this week as using Ninja was costly. tried one final time on MT4 failed badly. thankfully I got trade station with FXCM to be as close to NT as I need. Tonight's Live trades 2nd post.

Demo from May till his week below from ninja. all 1 min 1-12 point wins. basically trade trend changes. Just started live trading with FXCM tonight will give it a few months. Goal is to go back to Interactive and trade the DAX Future off Ninja with Book Trader... but full size futures are a while away yet. feel like i am finally getting it, on the sort term but 1 month from now I might be back to square one. this is the longest I have been profitable week to week using this approach.

cheers for reading.

from wanting to quit trading one moment to starting to see some light now. it's a hell of a market and really tests your mental composure. CL had it's moments bu never felt mentally drained as with trying to get somewhere with the DAX.

went through 5 ideas till reaching this point. made brokers a bit of coin while getting cut to sheds most weeks.

think i am finally onto something... but a little early to call a sure thing. I tried 4 different time frames to finally settle on the 1 min. thought about this for a while. 1 min we all hear it's to hard to read and trade. for me atm it's the only time frame i can use with any accuracy. spent a lot of time on 5 min 3 min 2 min thinking the 1 min was a waste of time.

traded live and demo since Dec last year trying and trying to find something. nonstop screen time every day. this post is more a emotional release then anything as my wife thinks i dumb trading and none of my mates would care to hear it all out. sorry ASF you're all i have. I tried and tried on MT4 to trade the DAX but i could never get any ware. I don't think it's possible with MT4. Once i switched to Ninja Trader i started to progress quickly.

I have been using FXCM through NT and thankfully i got trade station to look just like Ninja and I can read it like Ninja. Trading off chart trader is a killa best use it for free with a plug in due to the coms and buying cost. so i was a bit depressed this week as using Ninja was costly. tried one final time on MT4 failed badly. thankfully I got trade station with FXCM to be as close to NT as I need. Tonight's Live trades 2nd post.

Demo from May till his week below from ninja. all 1 min 1-12 point wins. basically trade trend changes. Just started live trading with FXCM tonight will give it a few months. Goal is to go back to Interactive and trade the DAX Future off Ninja with Book Trader... but full size futures are a while away yet. feel like i am finally getting it, on the sort term but 1 month from now I might be back to square one. this is the longest I have been profitable week to week using this approach.

cheers for reading.