>Apocalypto<

20.03.2012

- Joined

- 2 February 2007

- Posts

- 2,233

- Reactions

- 2

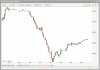

decent day yesterday, took a few hits then turned it around with two shorts on GLD and WTI. Oil looked like trying to set up a run but once it ran out of steam it shaped up nicely for a cont down. Long WTI atm see chart.

if i could do it again the GLD buy was a decent entry but it was an inside bar setting up for the sellers. i should have passed.. awww hindsight.

if i could do it again the GLD buy was a decent entry but it was an inside bar setting up for the sellers. i should have passed.. awww hindsight.