CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

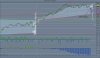

Well I'm thinking yesty's low was a bit poor and will be re-visited. However, I'm a little biased as I'm short half a dozen US Power Setups and hoping they hold...