- Joined

- 8 June 2008

- Posts

- 13,236

- Reactions

- 19,531

Another one bites the dust while

www.macrobusiness.com.au

And

www.macrobusiness.com.au

And

Kicking the can nicely

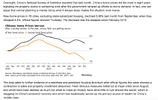

Chinese buyers rush back into Aussie property

Property portal, Juwai IQI, recently ranked Australian property as the world’s most popular destination for Chinese buyers. The increasing interest in Australian property has been driven, in part, by the Chinese government’s directive that foreign-enrolled students return to universities for...

Kicking the can nicely