- Joined

- 21 June 2009

- Posts

- 5,880

- Reactions

- 14

Your a d""khead TH for presenting facts.

Yeah .. you are right satanoperca .. sunshine and lollipops for everyone in the property market as a noted professor used to say

Meanwhile back at the coal face ....

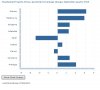

http://www.abs.gov.au/ausstats/abs@.nsf/mf/6416.0

It would seem only Sydney is performing the heavy lifting with Melbourne playing catch up.

Our money, somebody else's wealth. Awesome.

Our money, somebody else's wealth. Awesome.