- Joined

- 10 December 2012

- Posts

- 3,632

- Reactions

- 9

What a load of FAFF !! In the 1950s the average size of a new house was 115 square metres. By 1985 it had grown to 170 square metres, and in the last 15 years it has shot up to 221 square metres. As a result, the amount of space for each occupant in a new house has more than doubled since the early 1970's.

Maybe the rampant consumerism as well as the "Keeping up with the Jones's" has something to do with this eh? Statistics can be skewiffed to entail whatever outcomes the propaganda machine wants you to chow down on.

It is also not three times HARDER ... it is three times LONGER

Which ever way you spin it the fact is home loans are massive compared to what they were a couple of decades ago, and more and more people are hitting retirement still with mortgage debt.

The inescapable fact is the value of the land for housing is the MAJOR determinant to the cost increases for shelter. We've seen the average plot of land fall from 700 sqm to just 500 sqm. So the size is reduced by 28% but the cost went up 500%

The ACT has recently cut back on new land sales to help prop up the market. Pretty much any time the market tries to get back to some semblance of affordability some level of Govt steps in to keep the ponzi going. Not sure how many more re-inflations it can go through before the final bursting.

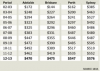

Research showing median prices per hectare of vacant land on Melbourne’s urban fringe increased following the introduction of the Urban Growth Boundary (UGB) in 2003. Measured in 2008 dollars, vacant land inside the UGB rose from $308 843 in 2003 to around $1.2 million in 2006. At the same time, land prices outside the UGB increased much slower from $98 378 per hectare in 2003 to just short of $200 000 in 2008””a doubling of land value as opposed to land value increasing by four within the UGB.

Fix up land supply and you pretty much fix the affordability issues.