- Joined

- 21 June 2009

- Posts

- 5,880

- Reactions

- 14

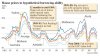

Exactly. If you buy when rates are 15% then you can reasonably assume that they are unlikely to rise much further. Give it a few years with wages growth and declining interest rates and it all becomes fairly easy.

But with rates at 6% and slow wages growth, you could well find yourself paying an increasing proportion of your income in interest payments in the years ahead. You don't have the benefits of falling rates and wage inflation working in your favour.

There's a definite risk that interest rates rise faster than wages from this point - indeed with rates so low practically any adjustment represents a significant rise in the cost of borrowed money. Eg raising official interest rates by just 1% represents an approximate 18% jump in the cost of borrowed money to consumers which is rather significant.

Maybe you are forgetting that interest rates were not always at 15% ... they ROSE to 17%. Prior to that they were around the 9% mark for quite some time. It is one thing to cherry pick the data it is another to completely ignore facts.

Why would interest rates bother you at the moment when you can get a 10 year FIXED loan under 7%?

http://www.rams.com.au/home-loans/fixed-rate-home-loan/ or 6.77% to be precise !

Affordability? Things were a LOT worse back in the 80's my friend.