- Joined

- 3 July 2009

- Posts

- 27,821

- Reactions

- 24,827

I'm not sure that you've understood what I am driving at!

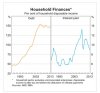

Remember that mean wages were much lower and interest rates were triple what they are today!!

Yes, and I borrowed and am where I am today?

Interest rates were high, but house prices were low and you could negative gear the loses.