- Joined

- 6 January 2009

- Posts

- 2,300

- Reactions

- 1,130

Hi,

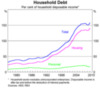

Just curious, does anyone have any stats on the growth in mortgage debt against the growth in prices for the last two years?

Just interested if the current prices rises have been a direct result of increasing debt levels and if so, if this debt growth cannot be sustained would it result in prices coming back down to earth and a few people getting burnt fingers.

It seems our friends and allies in the US had unprecedented debt growth which resulted in super charged price increases, as that growth in debt has receded so have prices.

Cheers

Just curious, does anyone have any stats on the growth in mortgage debt against the growth in prices for the last two years?

Just interested if the current prices rises have been a direct result of increasing debt levels and if so, if this debt growth cannot be sustained would it result in prices coming back down to earth and a few people getting burnt fingers.

It seems our friends and allies in the US had unprecedented debt growth which resulted in super charged price increases, as that growth in debt has receded so have prices.

Cheers