- Joined

- 8 March 2007

- Posts

- 2,940

- Reactions

- 4,078

Ahoy Brave and Loyal Crew

"Stay the Course" It does not look good

We had no choice this morning

All Stop Loss Orders would have failed with the Gigantic Gaps Down

I have always found that TECHNICAL STOP LOSSES don't work when you need them the most

They just can't handle Massive Down Gaps on the open

and Massive Up Gaps in good times

Crikey!

I don't know how any Mechanical System/ Formulae can Operate with large GAPS

in either direction on the open

In my mind if all the Mechanical Statistics don't cover LARGE GAPS in either direction I think they should be thrown overboard without hesitation

PLEASE!The problem (at least for IEF that you have the chart up for there) is you are charting an asset for what is effectively just 6.5 hours/5 days of a 24 hour/5.5-6 day trading session in ZN futures.

The stoploss would have worked fine on ZN, there wouldn't be those gaps.

PLEASE!

Show me where any Realistic Stop Loss would have worked TODAY on any share on the ASX

I wait with much anticipation!

View attachment 146825

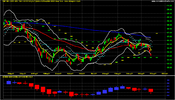

PleaseAlso, FWIW, to my actual point, here is the SPI futures which trade 23/6, you will note: no gap

View attachment 146828

NO!uh...that wasn't what I was saying at all, but fine:

The below chart plots the ratio between

Note, that's just 1ATR. Not 2ATR, or 3ATR. A very "tight stop".

- the absolute value of the open price minus yesterdays close, vs

- the 14 day ATR

Any value less than 1 would have "worked"...

Here's that ratio for BHP, one of the largest companies on the ASX, with a helpful green line to show you where you are wrong.

View attachment 146827

What do I win

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.