- Joined

- 3 May 2019

- Posts

- 6,349

- Reactions

- 10,041

Good point Peter and I had to think about it a bit before answering.You made such an interesting case for BPT that I read through the latest report.Naturally I didn't understand the financials but I did like the bit you underlined. If BPT is so financially sound that it can hang on through this oil crisis then their longer term outlook must be favourable.

How can we buy BPT and have the similar ability to hang tough through this economic crisis? I'll keep an eye on BPT and buy a 1/2 sized position if the price dips lower than the recent low. This may happen at the next monthly oil futures expiry. We'll see. Otherwise I'll wait for my normal BO-HR trigger.

Are you prepared to hold on to your current company convictions? (Until proven incorrect of course).

I've been interacting with fellow ASF members in some of the Gold price threads and have been waiting for a good price point to get involved with some local Gold stocks.

ducati916 and rederob have alerted us to the possible wedge/triangle formation in Gold price over the last number of days and finally breaking out to the upside from the close of US session overnight. Below is a couple of charts that I got to see, once again thanks goes to the ASF members mentioned:

View attachment 103490

this wedge has now broken to the upside.

View attachment 103491

I bought two stocks today and both are local Aussie stocks. There are many Gold stocks that have their projects in other parts of the world that come with Geopolitical risks like Governments that confiscate the Gold projects once a company has spent millions of $ exploring, developing and finally getting to the stage of mining the stuff. This is not some ancient argument, its happened as recently as last month for a PNG project as alerted by one of the ASF members on another thread

Australia and Canada has been recognised as the prime real estate grounds for mining investment because companies are able to keep their projects and reap the benefits finally when they get to mining the commodity.

Both stocks have top Australian projects and the share prices hasn't yet taken off to the moon ! First stock is Alkane Resources Limited (ALK) and has been extensively covered previously on this thread as it is on to one of the latest large Gold deposit discoveries at Boda. Second stock is Gold Road Resources Ltd (GOR) and it is about to break up into all time high's. If it does, much higher prices may be expected.

Open Portfolio:

View attachment 103493

Thanks for the info Rosscoe62. I was aware of Chalice and it's having a great run at the moment. Will research AUT and will put into my watchlist of Gold stocks if the prospects makes my eyes pop.If you really want to take a few speculative gold stocks try these. A rather large gap to fill with CHN

https://www.barchart.com/stocks/quo...&sym=CHN.AX&grid=1&height=500&studyheight=100

And AUT ....

https://www.barchart.com/stocks/quo...&sym=AUT.AX&grid=1&height=500&studyheight=100

Highly speculative gold carriers but running as quickly as the wind can blow at full pelt ...

FWIW: Costa was bought yesterday on one of my system, you are not alone being positive!!!Every now and then there has been enquiries from fellow members as to how the investment philosophy or trading method is formulated in this portfolio. The answers may have been disappointing because the expectation was a precise step by step method or that of a recipe. If the request was for a chocolate cake, I would have been able to readily provide a recipe, but I don't actually have one for the spec portfolio. Not holding anything back because I love sharing information and this portfolio thread would be like looking inside my head as to how I come up with suitable candidates.

So I will try to further explain the various methods of getting initial brainstorming ideas, before diving deep into research and number crunching to find stocks. I either look at macro themes (economic/geological/political) and work my way down to see if there is a stock specific way to action that theme (top-down approach) or I look at specific commodities like Oil and Gold prices and research down into individual stocks exposed to that commodity or sometimes it's interesting news about a specific stock that gets me digging for answers and looking outwards at the bigger picture (bottom-up type of approach).

So today's stock idea came from a macro theme and I will walk through the process of bringing the narrative down to an actionable stock pick... which has been added to the portfolio.

Australia is in the middle of a geopolitical crossfire. We are being pulled by the East and the West that it's nearly impossible to sit on the fence and pretend "she'll be right mate !". Not to mention what's at stake in terms of our economy and our way of life and the path we set for our future.

The virus may have provided the initial trigger, but I don't think there has been a more defining moment in our lifetime than what we are facing right now...

From the East we are facing the toughest challenges from our biggest trading partner who can use a lot of political muscle and some nasty tactics to test how far we are willing to bend. They are crushing our Barley farmers with new tariffs and banning some beef exports from Australia:

View attachment 103767

Perhaps the threats and boycotts are also helped by the Australian Chinese Ambassador who has been making damaging comments to the Australia-China relationship: (see highlighted in box below)

View attachment 103768

I thought an Ambassador is a person who builds relationships between the nations and helps to repair any tensions ?

Because the tensions are rising...

View attachment 103770

From the West we are influenced to push ahead with the origin of the virus enquiry and support Trump. Also forced to make a stance with them on other issues or be cut off !

View attachment 103769

Where things will lead and what impact/s it'll have on the lucky country is yet to be seen. However the trade war is unlikely to go away without further damage...

In such a geopolitical environment we could get hurt leaning towards either direction as we are stuck between the most powerful super-powers of the modern world. I think PM Morrison is diverting the attention away from the heat towards supporting the local economy and job creation:

View attachment 103771

Local businesses are likely to get promoted as we are encouraged to buy Australian. There is not a lot of "Australian Made" but there are lots of "Australian Produce" that we consume and export. In fact Australian farming is the big diversifier away from mining. I am not able to partner up with Australia's wealthiest person Gina Rinehart who has lately invested heavily into farmland and agriculture diversifying from her Iron Ore riches. So I thought to research up any publicly listed companies that I could buy into...

The research has taken me on many journeys from A2 milk producers, Select Harvesters, Grain Corporations to Cheese makers. This is where I spend most of the time on doing company research once the broader theme has been narrowed down to specific asx listed companies.

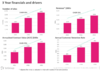

In the end, I decided to buy a fresh produce grower that brings the freshest Bananas, Avocados, Berries and various vegetables straight to our local stores. Costa Group Holdings Ltd (CGC) is the largest fresh produce grower in the country. Here are the details:

View attachment 103772

Severe draughts and a few mushroom growing issues has pushed the share price down to sub $3 levels after reaching an all-time-high of $9 in mid-2018. But the company is putting the efforts in now and looking ahead to better results in a year or two:

View attachment 103773

So if the share market is forward looking, my speculation is that prices may start to reflect what's in store down the track sooner. Still don't know if there is any other surprises in the store. But I think the worst could be behind this historic Australian company who's beginnings go back to the start of the century around 1903.

I know there is very little impact from the virus threat to the company's products as most of the fresh produce goes straight to the major supermarkets and green grocers around the country and people still need to eat, even if they cut down on luxury goods due to loss of jobs or reduced income due to cut hours etc. I might even argue their product (fresh produce) may be in more demand than ever as people try and eat healthy to build up their immune defences against the threat of catching the virus.

I specifically went to a lot of extra detail on this post to answer some of the questions over the years, hope it helps to explain the process, time, effort and thinking going into stock picks.

Open Portfolio:

View attachment 103774

Great to hear that our different systems and methods converge to the same stocks.FWIW: Costa was bought yesterday on one of my system, you are not alone being positive!!!

I try to restrain from discretionary trading/investment but for the reit discussed, are we not buying a dual business: one real estate side of brick and mortar and one pure childcare and associated side.Although I haven't changed my cautious view, restrictions are slowly starting to ease and schools have re-started to near normal capacity. Along with a whole host of other industries that are also coming out of lock down, it could be good for service providers like waste pickup companies, so BIN could be considered much less risky than at the time of buying in this portfolio. Time will tell...

ASX had a big day and I decided to add two more companies to the portfolio.

With the rebound in our market, I've been watching the leaders driving it as well as hot sectors. Even drilling down to certain sub-sectors. So what's the hottest cluster of stocks that have led the bounce with quite a few pushing into all-time-high's surpassing pre-Covid peaks ?

It's a sub-sector of the Financials which is broadly known as 'Fintech' or Financial Tech companies. A quick glance at APT or PPH charts will show how hard and fast they have run and led this sector. I am scared to touch these as I have a history of "momentum curse". In other words these stocks will continue higher till I buy and then go the other way. I know quite a few fellow forum members are all over these type of fast moving stocks and I do not wish to cause their gains to evaporate. So I'll stick to what I am familiar with and that is to look for stocks that haven't run as hot yet.

If we take the real-estate analogy to buy the 'worst house in the best street' I guess I would still like to buy a stock that is in the red hot Fintech sector that hasn't caught much attention yet and is not valued at multi-billion dollars. So after a dozen or so comparisons, I decided to purchase some shares in the Fintech junior QuickFee Ltd (QFE).

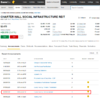

With schools returning to somewhat normal attendance levels and businesses re-opening, there is a whole host of other feeder industries lined up to benefit. One that comes to mind is the childcare industry. An old favourite of the 'spec portfolio' Charter Hall Social Infrastructure REIT (CQE) is trading far below the price it was purchased at last time, although it was called a slightly different name but still had the same stock code.

I didn't buy up to this point as there was still risks of child care centre closures or low kid numbers that may affect the company. But with the current easing I think the risk/reward is much more favourable and given they haven't cut the dividend during the lock-down it's likely to be kept going forward, which is highly attractive at current share price and in an almost no yield interest rate world.

View attachment 103800

Open portfolio:

View attachment 103801

Thanks @aus_trader for the insight. I am in awe and really enjoyed it. While I guess you make (most?) entries on the broader consideration that influence the fundamentals of companies and do you own perceptive forecasts on which companies may benefit, do you ever EXIT using the same? I would guess most exits would be on price action.Every now and then there has been enquiries from fellow members as to how the investment philosophy or trading method is formulated in this portfolio. The answers may have been disappointing because the expectation was a precise step by step method or that of a recipe. If the request was for a chocolate cake, I would have been able to readily provide a recipe, but I don't actually have one for the spec portfolio. Not holding anything back because I love sharing information and this portfolio thread would be like looking inside my head as to how I come up with suitable candidates...

I try to restrain from discretionary trading/investment but for the reit discussed, are we not buying a dual business: one real estate side of brick and mortar and one pure childcare and associated side.

If either goes down aka RE component, the SP should go down

I guess you are betting that neither RE or childcare businesses have negative outlook?

Thanks @aus_trader for the insight. I am in awe and really enjoyed it. While I guess you make (most?) entries on the broader consideration that influence the fundamentals of companies and do you own perceptive forecasts on which companies may benefit, do you ever EXIT using the same? I would guess most exits would be on price action.

A like is not enough, thanks for providing us with your thinking and research process.Very good broad level thinking qldfrog. Yes it's a real estate business as well, although not a franchise like McDonald's which is also a real estate business for those who thought it's a pure burger chain. So there is some risk with commercial real estate tanking and affecting the CQE share price while the childcare business could be thriving. This leads me to answer the question by jbocker very precisely and succinctly:

I rarely use the exit using the same level of analysis, however I may take adverse developments to head to the exit which is once in a blue moon. As an example see the last time CQE was in the portfolio and I was sweating it when it didn't report the dividend amount/date right up to the ex-date and it was paying close to or above 100% payout ratio and exited the position soon after.

So you are correct, I use the share price action either chart based or as a maximum % I am willing to lose on my position as an exit criteria. In answering the qldfrog question above and a similar question by Peter2 about another current holding in this portfolio (BPT), I have shown that this is not a buy and hold portfolio. I could have done 10 hours of research and a lot of thinking to come up with the stock selection at the time of purchase but there are things that are beyond my capacity to de-risk in doing so. The unforeseen risk of commercial real estate market on the CQE stock at the time of buying is a good example, although CQE has recently raised capital to strengthen it's balance sheet:

View attachment 103853

Thanks Trav.@aus_trader a little of topic mate but I was typing in your portfolio stock codes into a watchlist and noted that I was pressing B, C & Q a few times so maybe I could filter stocks based on that condition.

Anyway great post above mate and keep up the good work.

Trav.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.