- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

Added the lighting specialist that is in an expansion growth spurt at the moment, namely Beacon Lighting Group Ltd (BLX). This is not the average lighting isle in the local hardware store, they specialise in all types of lighting from ultra-modern latest designs to the Classique vintage designs that are coming back in vouge as well as ceiling fans with advanced designs that retract the fan blades (when not in use) within a light fitting amongst other innovations:

Retail environment is tough in Australia, but these guys are battling it head on in two fronts: (1) with the use of social media platforms:

(2) international expansion spree:

Impressed with management's execution as well of late: jumping on opportunities and cutting losses early and promptly by exiting unprofitable ventures. Here is a case study where they have renovated and re-purposed for a profit. It's like renovating and re-structuring your rental property on a much bigger commercial scale, doubling the asset value. But in this case done radically quick, all within this year:

Stock offers a decent 3.7% steady dividend yield:

Open Portfolio:

Retail environment is tough in Australia, but these guys are battling it head on in two fronts: (1) with the use of social media platforms:

(2) international expansion spree:

Impressed with management's execution as well of late: jumping on opportunities and cutting losses early and promptly by exiting unprofitable ventures. Here is a case study where they have renovated and re-purposed for a profit. It's like renovating and re-structuring your rental property on a much bigger commercial scale, doubling the asset value. But in this case done radically quick, all within this year:

Stock offers a decent 3.7% steady dividend yield:

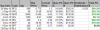

Open Portfolio: