- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

I've been looking at the outcome of the current stocks in the portfolio and it's clear that it hasn't been easy picking stocks for the recovery. Some have given back all the recent gains plus some e.g. BIN.

So I am looking for stocks which not only could offer some general economy based recovery but also specifically targeted to benefit from the pandemic, call them 'pandemic stocks' if you like. Some changes are likely to become part of the future and one of those things is remote/online learning.

I have been researching stocks in this space and I quite like the Children's online Education company 3P Learning Ltd (3PL), so bought some shares. They provide online learning programs like Mathletics and Reading Eggs to improve children's Literacy and Numeracy skills. Due to constant distractions as a result of shut downs, it becomes increasingly difficult for Schools to provide the consistent learning environment based in classrooms. Therefore companies like 3PL are gaining traction as alternative learning tools that Children can use from home. 3PL has recently won a $10m contract which will add to their revenue:

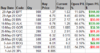

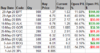

Open Portfolio:

So I am looking for stocks which not only could offer some general economy based recovery but also specifically targeted to benefit from the pandemic, call them 'pandemic stocks' if you like. Some changes are likely to become part of the future and one of those things is remote/online learning.

I have been researching stocks in this space and I quite like the Children's online Education company 3P Learning Ltd (3PL), so bought some shares. They provide online learning programs like Mathletics and Reading Eggs to improve children's Literacy and Numeracy skills. Due to constant distractions as a result of shut downs, it becomes increasingly difficult for Schools to provide the consistent learning environment based in classrooms. Therefore companies like 3PL are gaining traction as alternative learning tools that Children can use from home. 3PL has recently won a $10m contract which will add to their revenue:

Open Portfolio: