- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

Thanks Zaxon, it's the consistency of dividends/distributions that I based my investment decision on when I purchased. The upcoming dividends are usually declared in advance, for example with one of the other Charter Hall products called Charter Hall Long WALE REIT (CLW).Here is the history of CQE's distributions. They've been pretty consistent, so if history is any guide, expect it around 27/28 Sep 19. They've also distributed identical amounts four times in a row, then the amount changes for the next year. So if that pattern continues, expect greater than 4 cents.

View attachment 97469

Anyway while waiting for them to respond to my query, I've been doing a bit more digging into the financials. It's a bit easier to do with a clear head since I can look at things kind of independently since my position is sold and my money is not involved since this is a real portfolio and not a hypothetical one.

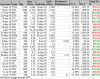

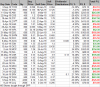

I was looking at the same area that you were looking at and found that in the year that just passed, they have paid more in distributions than their earnings of 12c:

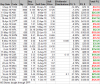

While they paid out 16c:

So I think it would be unwise to assume they will pay greater than last year's distribution. Something seems odd, will have to investigate and clarify before re-investing in it.