- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

Let go of Aveo Group (AOG) because I am scared as to what might happen once the indicative proposal is lapsed on the 22nd (see snippets of announcements):

'Aveo received a confidential non-binding and conditional indicative proposal (the Indicative Proposal), from the preferred party'

"The IBC has indicated that if the agreements leading to a Scheme of Arrangement cannot be agreed by Monday, 22 July 2019, the whole-of-company sale transaction process will be discontinued."

Added Clean TeQ Holdings Limited (CLQ), which did well in this portfolio in the past. Past results are not indicative of what may happen, so I could be buying too early and it might continue down in which case it will have to be sold at a loss. Just can't ignore the potential though. CLQ is getting the plan together to supply the Electric battery market with two of the key needed commodities, namely Nickel and Cobalt. These are also key components in hardening steel. CLQ's 'Sunrise' project is big and up there with the projects held by the major mining companies:

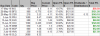

The DFS conducted last year has pretty good statistics, so looks like a pretty good stock to me:

Current Portfolio:

'Aveo received a confidential non-binding and conditional indicative proposal (the Indicative Proposal), from the preferred party'

"The IBC has indicated that if the agreements leading to a Scheme of Arrangement cannot be agreed by Monday, 22 July 2019, the whole-of-company sale transaction process will be discontinued."

Added Clean TeQ Holdings Limited (CLQ), which did well in this portfolio in the past. Past results are not indicative of what may happen, so I could be buying too early and it might continue down in which case it will have to be sold at a loss. Just can't ignore the potential though. CLQ is getting the plan together to supply the Electric battery market with two of the key needed commodities, namely Nickel and Cobalt. These are also key components in hardening steel. CLQ's 'Sunrise' project is big and up there with the projects held by the major mining companies:

The DFS conducted last year has pretty good statistics, so looks like a pretty good stock to me:

Current Portfolio: