- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

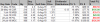

Big down day overnight from the US markets followed by yesterday's falls, so I have been clearing out the bulk of the stocks in this portfolio. Only a few remain that have a bit of resilience in this environment such as Gold mining and Early learning Centre REIT. I guess kids have to go to Kindies in all economic environments so may be considered as a defensive stock IMO and so far haven't been savaged by the market, fingers crossed...

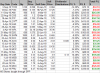

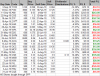

Closed:

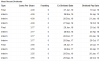

Closed: