Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 14,062

- Reactions

- 11,229

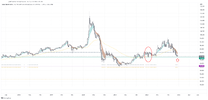

On the US forums/press it is all doom and gloom for silver atm.I'm surprised that silver has gotten down to as low as ~A$26.20 earlier this evening. I wonder what the AISC per ounce is for the lowest cost silver producers? The recent silver bear market feels overdone.

There must be a bounce soon surely? The gold/silver ratio is currently 95, which is historically very high.

View attachment 146197

It may be a good time to buy.

gg