- Joined

- 2 August 2016

- Posts

- 897

- Reactions

- 1,491

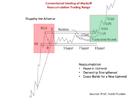

Careful Roller. That looks like liquity to target, to me.

It wouldn't surprise me to see some consolidation around those highs and then it rip straight through.

It wouldn't surprise me to see some consolidation around those highs and then it rip straight through.